Author: Oregon Association of Minority Entrepreneurs

-

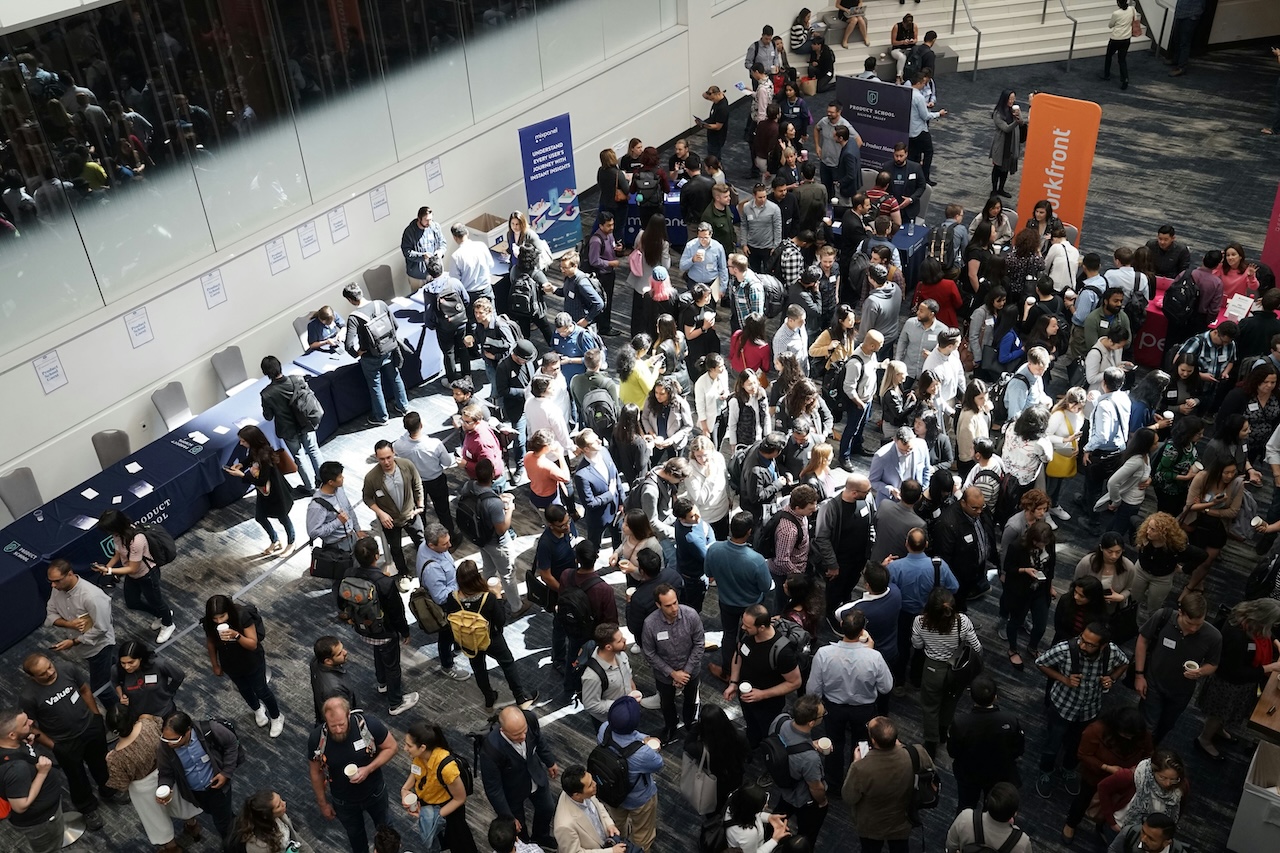

A Successful Day of Connections at the OAME Public Agency Meet-and-Greet

In August OAME hosted a highly successful event connecting local public agency project managers with OAME member professional services providers. The event provided a unique opportunity for businesses to showcase their offerings and explore potential contract opportunities. With over 25 businesses represented and a strong turnout from public agencies like Metro, TriMet, the Port of…

-

Young Bosses Take Flight at OAME’s Youth Entrepreneurship Conference

This summer’s OAME Youth Entrepreneurship Conference ignited a spark of ambition in attendees aged 14-21. This empowering event provided a launchpad for budding entrepreneurs, equipping them with the tools and knowledge to turn their passions into thriving businesses. The conference buzzed with energy as enthusiastic young minds delved into the world of entrepreneurship. Experienced coaches…

-

Minority Business Financing Made Easy: OAME SBA Loans in Oregon & SW Washington

Struggling to secure traditional bank financing for your minority-owned business in Oregon or southwest Washington? The Oregon Association of Minority Entrepreneurs Credit Corporation (OAMECC) can help! We offer SBA loans specifically designed to address the unique challenges faced by minority entrepreneurs. OAMECC is here to empower your minority-owned business in Oregon and SW Washington. We…

-

THE WHYs and HOW of being an OAME Member

The Oregon Association of Minority Entrepreneurs (OAME) isn’t just an organization; it’s a thriving community dedicated to empowering minority-owned businesses. With a membership exceeding 550, OAME fosters a powerful network that connects entrepreneurs, public agencies, non-profit partners, and even larger corporations. We couldn’t do it without you! A big thank you to all our members.…

-

37 Years Strong: A Look Back at the History of OAME

The Oregon Association of Minority Entrepreneurs (OAME) is celebrating a milestone year! Since 1987, they’ve been a driving force in empowering and supporting minority-owned businesses in Oregon and Southwest Washington. Let’s take a trip down memory lane and explore the rich history of this impactful organization. OAME’s Humble Beginnings started in 1987 as an idea…